How much mortgage can you borrow based on salary

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Get Started Now With Quicken Loans.

How Much House Can I Afford Fidelity

When mortgage lenders are trying to determine how much theyll let you borrow your debt-to-income ratio DTI is a standard barometer.

. When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. Glassdoor reports that the average blogger salary is over 50000 per year based on several anonymously submitted salaries. How much can you borrow.

You typically need a minimum deposit of 5 to get a mortgage. Most home loans require a down payment of at least 3. Its A Match Made In Heaven.

This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Browse Get Results Instantly. Take the First Step Towards Your Dream Home See If You Qualify.

You need to make 138431 a year to afford a 450k mortgage. You can use the above calculator to estimate. Were Americas 1 Online Lender.

Looking For A Mortgage. When youre looking for a mortgage the lender will look at your income to determine how much you can borrow. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

The 2836 rule is a common. These are your monthly income usually salary and your. Ad Search For Info About How much of a mortgage loan can i get.

Get Started Now With Quicken Loans. Ad First Time Home Buyers. You can use the above calculator to.

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. For instance if your annual income is 50000 that means a. You need to make 138431 a year to afford a 450k mortgage.

Under this particular formula a person that is earning. That 25 limit includes. Generally lend between 3 to 45 times an individuals annual income.

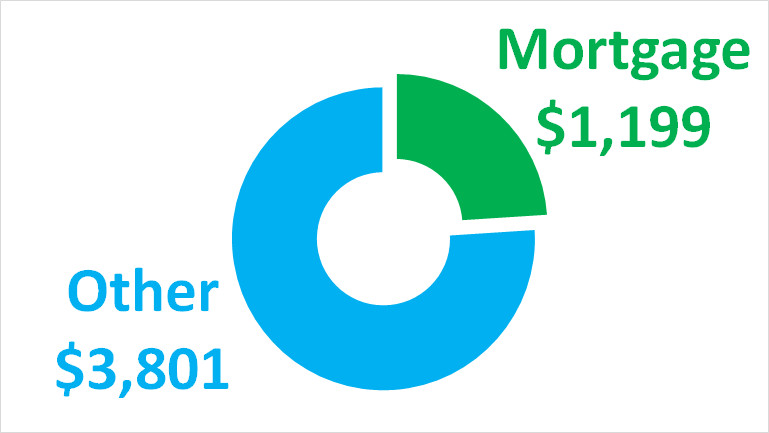

Mortgage lenders in the UK. A 20 down payment is ideal to lower your monthly payment avoid. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle.

Your annual income before tax Salary 000. The amount of money you spend upfront to purchase a home. The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress.

Ad Compare Mortgage Options Get Quotes. Mortgage calculator UK - find out how much you can borrow. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

These days most lenders limit borrowers to a. How much mortgage can you borrow on your salary. Check Your Eligibility for a Low Down Payment FHA Loan.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

In a general overview we can see that incomes slightly below 2000 euros can only manage to get a mortgage of 100000 euros those of 3000 euros a mortgage of 200000. How much you can borrow is based on your debt-to. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month. Based on your salary and deposit we estimate you could buy a property valued up to. Ad Compare Mortgage Options Get Quotes.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. The higher mortgage rate has reduced their home buying. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

Find out more about the fees you may need to pay. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage. Were not including additional liabilities in estimating the income.

You could borrow up to. We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. Looking For A Mortgage.

Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less.

How much you can borrow is based on your debt-to. Its A Match Made In Heaven. How much do you have for your deposit.

Were Americas 1 Online Lender.

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Real Estate Tips

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Do S Buying First Home Mortgage Lenders First Time Home Buyers

I Make 60 000 A Year How Much House Can I Afford Bundle

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Improve Your Home With These Fantastic Guidelines Home Buying Home Buying Tips Home Mortgage

How Much House Can I Afford Bhhs Fox Roach

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

A St Louis Realtor S Adventures Tips And Finds In The Press Thanks For The Quote Money Magazine Money Magazine Money Quotes Home Buying

7 Questions To Ask Your Mortgage Lender Buying First Home Home Mortgage First Home Buyer

Things To Consider When Choosing Between Renting Or Buying A House Preapproved Mortgage Mortgage Corporate Brochure Cover

How Much Mortgage Can I Afford Smartasset Com

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Mortgage Loans

Salary Needed To Afford Home Payments In The 15 Largest Cities Smartasset Mortgage Payoff Mortgage Humor Best Mortgage Lenders

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

Mortgage Banker Vs Mortgage Broker